This software will make your Balance Sheet in minutes. Prepare financial statements for Indian entities as per Companies Schedule III format and Non Corporate format. From Tally import to PDF export, this Excel tool automates each step of making your financial statements.

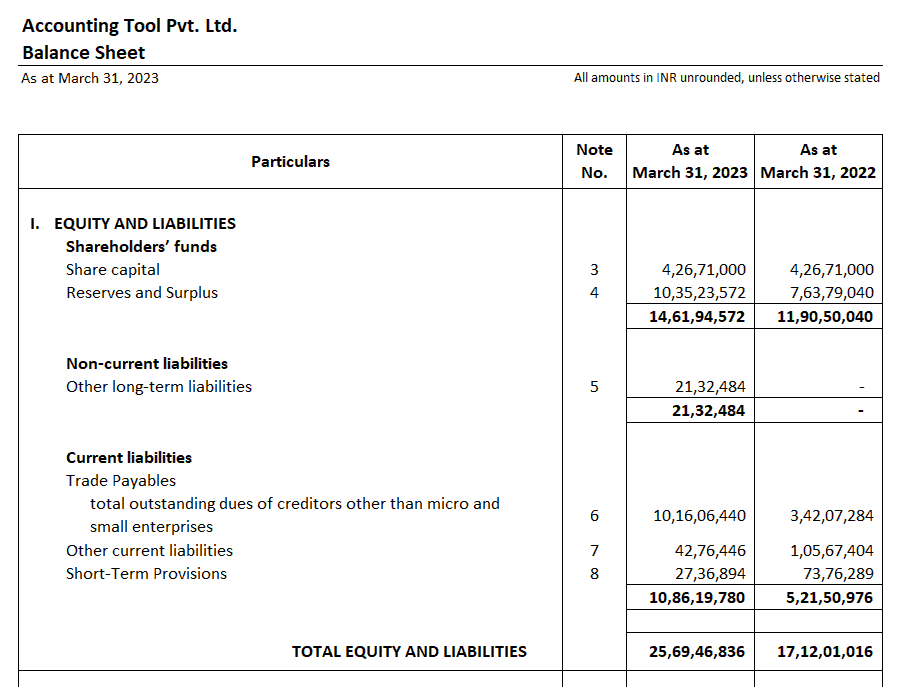

Balance Sheet Prepare corporate and non-corporate balance sheets in minutes. Never spend time tallying your Balance sheets.

P&L and Cashflow Get Instant reports on profitability and cash flow. No need to manually tally your Cash Flow Statements.

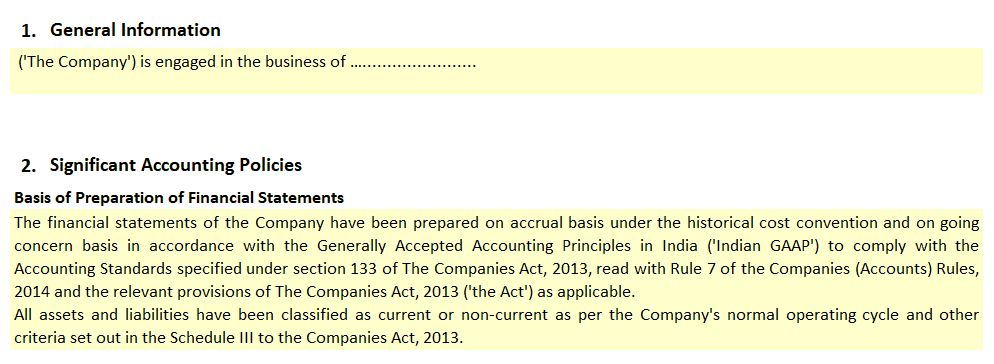

Notes Notes and Significant Accounting Policies as per the Indian Companies Act and AS are automatically populated.

Corporate Format Latest Format as per revised Schedule III of Companies Act 2013 for Non-Ind-AS Companies.

Non-Corporate Format Latest Format as per the guidance note on Financial Statements of Non-Corporate Entities.

Rounding Round all the amounts as per Schedule III. Rounded Totals are accurate to each decimal point.

Tally Import Import all the ledger balances from Tally in a single click. Auto Grouping of ledgers based on Tally Groupings.

PDF Export Export the Financial Statements in PDF format with automatic page numbering and layout settings.

Excel Export Export the Financial Statements in Excel format along with the Trial balance to make further customisations.

Year Change Single click change of Year or period. Automatic shifting of data to previous year columns.

Multiple Periods Prepare monthly, quarterly or yearly financial statements. Select financial or calendar year.

Branch Consolidation Import multiple branches from Tally and prepare consolidated financial statements.

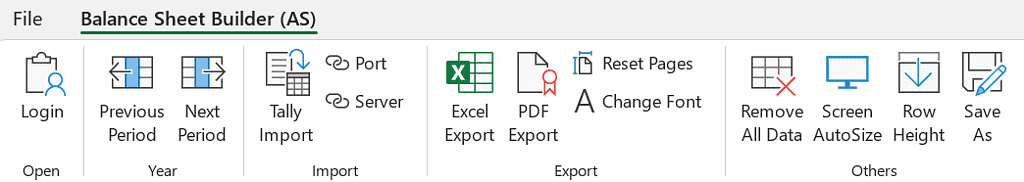

The Product Toolbar has a clean and simple interface. You can easily change the financial year, import or export data, and use all other features. Everything is accessible from a single location.

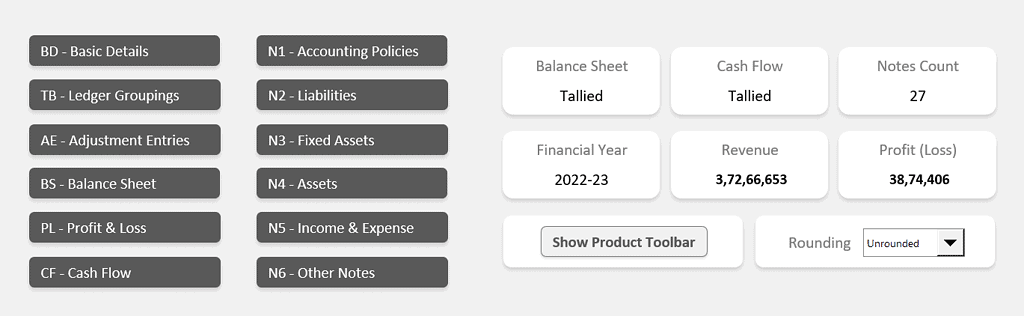

The Dashboard provides a streamlined interface for navigating through the whole Tool. It displays whether your balance sheet and cash flow are tallied. It also shows the total number of notes, current financial year, revenue, and profit.

Suggests Rounding options as per Schedule III and according to the current profits of the company. Rounded Totals are accurate to each decimal point.

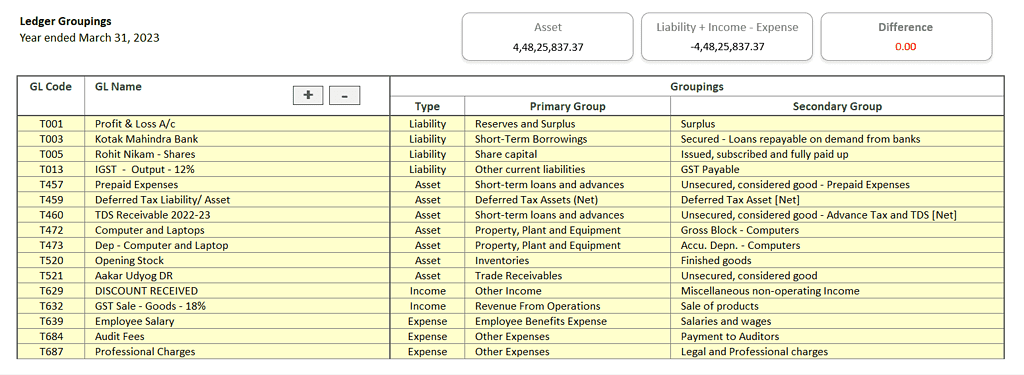

If you’re importing ledgers from Tally, it makes 100% groupings through Artificial Intelligence. For other accounting software, you can assign primary and secondary groups based on Schedule III of the Companies Act and Non-Corporates guidance note. It also alerts you of any differences in the Balance Sheet.

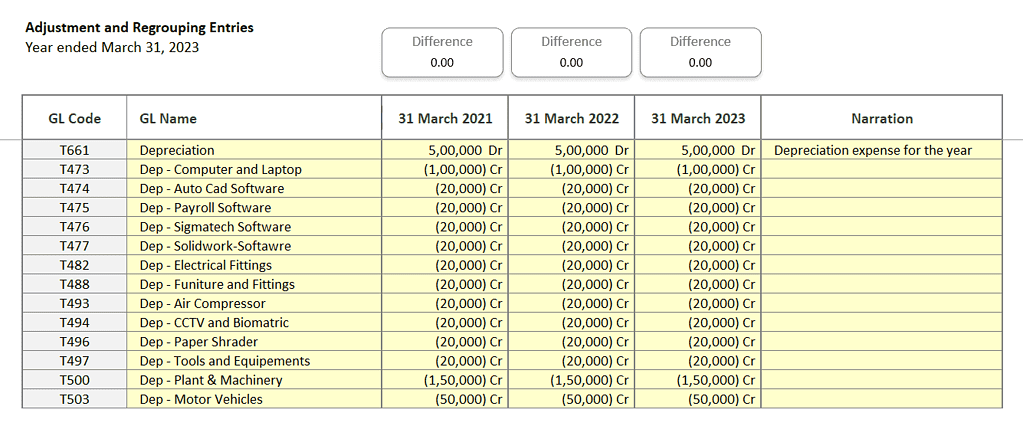

Make necessary adjustments, such as regrouping balances between current and non-current categories and other adjustments like tax and depreciation. It simplifies the year-end closing process by providing an easy way to pass all the finalisation entries for your financial statements.

Ready-made templates for Significant Accounting Policies. Only those policies which apply to the company are generated.

Balance Sheet, Profit Loss, and Cash Flow Statements are automatically populated from the Ledger groupings with appropriate Note Numbering. The vertical Balance sheet format is as per the ICAI guidance note for companies, LLP, partnership firms, and individuals.

₹3,999

1 PC, 1 Year

₹5,999

5 PC, 1 Year

₹8,999

20 PC, 1 Year

₹8,999

1 PC, Lifetime

₹13,499

5 PC, Lifetime

₹19,999

20 PC, Lifetime

To run this Tool properly, following are the minimum system requirements:

– Windows 7 or a newer operating system by Microsoft,

– Excel 2010 or a newer excel version by Microsoft.

As a desktop application, you can rest assured that your data is private and protected. Our top priorities are speed and performance, and as a result, this tool works just as efficiently as any other application.

How many Companies does the Tool support?You can use the Tool for as many companies as you want. Just make a separate copy of the Tool for each company.